City of Somerville Assessor's Portal

Cyclical Inspections: Assessors will be performing inspections at properties across the City that have not been inspected or sold in the last ten years. These inspections may take place during office hours, Monday through Friday. Representatives will carry a City of Somerville photo ID. If you have questions or concerns, please call us at (617) 625-6600 x3100 or email assessing@somervillema.gov.

Recently Improved Properties: Assessors will be performing inspections at properties across the City that have recently undergone improvements. These inspections may take place during office hours, Monday through Friday. Representatives will carry a City of Somerville photo ID. If you have questions or concerns, please call us at (617) 625-6600 x3100 or email assessing@somervillema.gov

Contact Us

Assessor’s Office:

617-625-6600 ext. 3100

assessing@somervillema.gov

somervillema.gov/Assessing

For information on how to pay your taxes, contact the Treasurer’s Office:

617-625-6600 ext. 3500

treasury@somervillema.gov

somervillema.gov/Treasury

Or drop by City Hall at 93 Highland Ave:

Monday - Wednesday

8:30 a.m. - 4:30 p.m.

Thursday

8:30 a.m. - 7:30 p.m.

Friday

8:30 a.m. - 12:30 p.m.

About the Board of Assessors

Under the provisions of Massachusetts General Laws, Chapters fifty-eight to sixty-five C, the Board of Assessors fall under the jurisdiction of the Commissioner of Revenue who may revise rules, regulations, and guidelines, as deemed necessary to establish minimum standards of assessment performance.

In Massachusetts, the property tax is an ad valorem (based on value) tax. In the late 1970s, the Massachusetts Supreme Court in the Sudbury Decision ruled that property values would be based on 100% full fair cash market value. Full and fair cash value is the amount a willing buyer would pay a willing seller under no special circumstances and given a reasonable exposure to the market. Assessors must use accepted Massachusetts’ appraisal techniques to value property.

In order to determine market value, a sales verification process is started by members of the assessing staff. Letters are sent to buyers and sellers to attest to the Arm's Length Nature of the sale to determine if there were special circumstances involved and to determine the condition of the property on the date of sale. Property measurements and current conditions of property are then updated on all sales. A complete statistical analysis is performed and must meet Department of Revenue standards to satisfy the Commissioners Standards of Performance in order to meet annual and triennial certifications before tax bills may be mailed.

The property tax levy is the revenue a community can raise through real and personal property taxes. Under Proposition 2 ½, there are limits on the amount of the levy raised by a city or town and on how much the levy can be increased from year to year.

Assessors annually classify all real property into one of four real property classes either residential, commercial, industrial, or open space. The City may then allocate the tax levy among the classes of real property within prescribed statutory limits. The tax rate applicable to commercial, industrial and personal property may be higher than applied to residential properties. Approximately 100 communities in Massachusetts opt each year to shift the tax burden from residential to commercial, industrial, and personal property classes rather than to apply the same rate to all classes of property.

Contact Information

Monday - Wednesday

8:30 a.m. - 4:30 p.m.

Thursday

8:30 a.m. - 7:30 p.m.

Friday

8:30 a.m. - 12:30 p.m.

City Hall Assessor's Office (Room 108)

93 Highland Ave.

Somerville, MA 02143

United States

Employee Directory

Dear Residents and Taxpayers of Somerville:

From the Assessors: Fiscal Year 2026 is a State Department of Revenue (DOR) Certification (Revaluation) year for the Board of Assessors. Unlike an interim adjustment year, a Revaluation requires the Board adjust values based upon changes in the market and ensure that DOR standards have been met.

The DOR meticulously reviews and approves any and all adjustments by the Board; the standards are enforced and involve a rigorous and comprehensive process to achieve certification. Assessments for FY2026 reflect values as of January 1, 2025, and were released to the public on December 31, 2025. They can be viewed in the Assessor’s Database. Assessed values will appear on your third-quarter actual tax bill issued on or about 12/31/2025. Taxpayers who feel that their property is overvalued must file a formal appeal (abatement) with the Board of Assessors by no later than February 2, 2026, but not before December 31, 2025.

Among other information, this update explains:

- How to find out your assessed value for FY2026

- The FY2026 tax rates

- Estimated average tax bills for residential homeowners

- How to appeal or file for abatement

- How values are calculated

- Property value trends in Somerville

- Information on property tax exemptions available to qualifying owners

Sincerely,

Francis J. Golden, MAA Chief Assessor & Chairman

Michael Flynn, MAA

Richard Scanlon, MAA

View Property Tax Update Mailer (PDF)

Translated Property Tax Updates: Español | Português | 简体中文版 | 繁體中文版

Assessor's Database

The Assessing Department maintains a database of commercial, industrial, and residential property values in the City of Somerville.

Property Tax Abatements and Appeals

Any taxpayer who feels that the value the Assessors have placed on their property does not reflect market value has the right to appeal. Application for abatement or appeal can be obtained at the Assessor’s Office or by clicking on the "Abatement Application" button below.

Note that abatement applications must be filed in the Assessors Office by no later than the close of business on February 2nd, 2026 or will be considered late at which point the Board of Assessors loses jurisdiction to abate the bill. Applications, however, will be accepted if mailed to the Assessors' Office and showing a U. S. postal postmark of February 2, 2026 or earlier. Also, note that an application can be e-mailed to assessing@somervillema.gov as long as it is received in the Assessors' Office by the close of business on February 2nd, 2026.

The Board of Assessors has three (3) months from the date of application to issue a decision. Applicants aggrieved by a decision of the Board can appeal to the State Appellate Tax Board within three (3) months of the date of the Board of Assessors' notice.

Note that the filing of abatement does not stay the collection of the tax. To preserve all appeal rights, bills should be paid timely by the due date without incurring interest.

If you would like more information about how to file for an abatement please read our:

English | Español | Português | Kreyòl Ayisyen | नेपाली | 简体中文版 | 繁體中文版

Additional inquiries can be made at the Assessors Office, by email at assessing@somervillema.gov, or by calling the Office at 617 625-6600 x3100.

Assessor's Maps

Below is a listing with detailed Assessor's maps of every section of the City.

Step 1:

View the Parcel Map Index to find the parcel map number of the area you are looking for, then come back to this page and click on that number in the list below to view a detailed parcel map.

Step 2:

Scroll through the listing below to find the correct map:

- Parcel Maps 1-50

-

- Parcel Map 1

- Parcel Map 2

- Parcel Map 3

- Parcel Map 4

- Parcel Map 5

- Parcel Map 6

- Parcel Map 7

- Parcel Map 8

- Parcel Map 9

- Parcel Map 10

- Parcel Map 11

- Parcel Map 12

- Parcel Map 13

- Parcel Map 14

- Parcel Map 15

- Parcel Map 16

- Parcel Map 17

- Parcel Map 18

- Parcel Map 19

- Parcel Map 20

- Parcel Map 21

- Parcel Map 22

- Parcel Map 23

- Parcel Map 24

- Parcel Map 25

- Parcel Map 26

- Parcel Map 27

- Parcel Map 28

- Parcel Map 29

- Parcel Map 30

- Parcel Map 31

- Parcel Map 32

- Parcel Map 33

- Parcel Map 34

- Parcel Map 35

- Parcel Map 36

- Parcel Map 37

- Parcel Map 38

- Parcel Map 39

- Parcel Map 40

- Parcel Map 41

- Parcel Map 42

- Parcel Map 43

- Parcel Map 44

- Parcel Map 45

- Parcel Map 46

- Parcel Map 47

- Parcel Map 48

- Parcel Map 49

- Parcel Map 50

- Parcel Maps 51-100

-

- Parcel Map 51

- Parcel Map 52

- Parcel Map 53

- Parcel Map 54

- Parcel Map 55

- Parcel Map 56

- Parcel Map 57

- Parcel Map 58

- Parcel Map 59

- Parcel Map 60

- Parcel Map 61

- Parcel Map 62

- Parcel Map 63

- Parcel Map 64

- Parcel Map 65

- Parcel Map 66

- Parcel Map 67

- Parcel Map 68

- Parcel Map 69

- Parcel Map 70

- Parcel Map 71

- Parcel Map 72

- Parcel Map 73

- Parcel Map 74

- Parcel Map 75

- Parcel Map 76

- Parcel Map 77

- Parcel Map 78

- Parcel Map 79

- Parcel Map 80

- Parcel Map 81

- Parcel Map 82

- Parcel Map 83

- Parcel Map 84

- Parcel Map 85

- Parcel Map 86

- Parcel Map 87

- Parcel Map 88

- Parcel Map 89

- Parcel Map 90

- Parcel Map 91

- Parcel Map 92

- Parcel Map 93

- Parcel Map 94

- Parcel Map 95

- Parcel Map 96

- Parcel Map 97

- Parcel Map 98

- Parcel Map 99

- Parcel Map 100

- Personal Maps 101–150

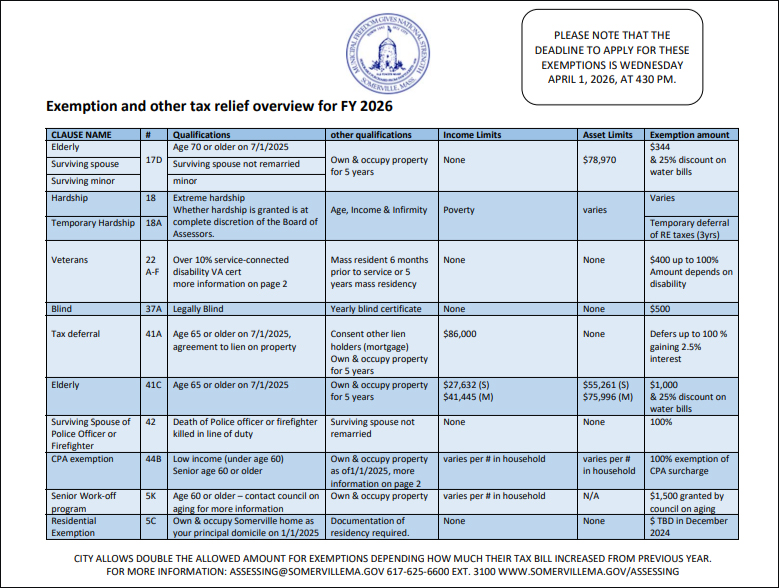

Flyer of Exemptions and Other Tax Relief

Property Tax Exemptions Flyer – English (PDF) | Property Tax Exemptions Flyer – Spanish / Español (PDF) | Property Tax Exemptions Flyer – Portuguese / Português (PDF) | Property Tax Exemptions Flyer – Haitian Creole / Kreyòl Ayisyen (PDF) | Property Tax Exemptions Flyer – Nepali / नेपाली (PDF) | Property Tax Exemptions Flyer – Simplified Chinese / 简体中文版 (PDF) | Property Tax Exemptions Flyer – Traditional Chinese / 繁體中文版 (PDF)

Residential Exemption

Each year, at the option of the Mayor and City Council, an exemption of not more than 35% of the average assessed value of all Class One, residential parcels, may be applied to residential parcels that are the principal residence of the taxpayer as of January 1st, 2025. The intent of the exemption is to promote owner occupancy. This option is put in front of the Mayor and City Council for acceptance at the end of December. Before December 2025 the status of the residential exemption for fiscal year 2026 is unknown.

| Clause Name | Clause# | Basic Qualifications |

Other Qualifications |

$$$ Amount | Forms |

| Residential Exemption | 5C | Own & occupy Somerville home as your principal domicile on previous January 1 | Documentation of residency required. | To Be Determined (amount changes each year) | Instructions & application |

Residential Exemption Instructions and Application

English | Español | Portugues | नेपाली | 简体中文版 | 繁體中文版

Personal Exemptions

Qualifying seniors, veterans, and others may apply for additional RE tax exemptions allowed under state law. The amounts are set by the State. Depending on how much your taxes increased over last year, the City also allows up to double the exemption amounts to be removed from your tax bill. To qualify for any of the exemptions you must own & occupy your Somerville home as your principal home on the qualifying date. The qualifying date for most of the Clause Exemptions for FY 2026 is July 1, 2025. Please note that if your home is held in a trust, you are the owner only if you are a trustee or co-trustee of that trust, and you have a sufficient beneficial interest in the home. Questions can be addressed to Assessing at 617-625-6600 ext. 3100 or email us at assessing@somervillema.gov.

| Clause Name | Clause# | Basic Qualifications as of 7/1/25 |

Other Qualifications |

Income Limits | Asset Limits | $$$ Amount | Forms |

| Elderly/ Surviving Spouses or minors | 17D |

Age 70 or older/ Surviving spouse or minor |

Own & occupy property 5 years | None | $78,970 | $344 & 25% discount on water bills |

Instructions & application |

| Hardship | 18 | Age, Infirmity, Income | Must meet all three (3) | Poverty | Varies | Instructions & application | |

| Veterans | 22, 22A thru 22F | At least 10% disability, varies per clause letter | Mass resident 6 months prior to service or 5 years Mass residency | None | None | $400 up to 100% | Instructions & application |

| Blind | 37A | Legally Blind | Yearly blind certificate | None | None | $500 | Instructions & application |

| Tax Deferral | 41A | Age 65 or Older, agreement to lien on property | Own & Occupy Property for 5 years | $86,000 | None | Defers Up to 100% gaining 2.5% interest | Instructions & application |

| Elderly | 41C | Age 65 or older | Own / Occupy 5 yrs. in MA & MA resident 10 yrs. | $27,632 (S) $41,445 (M) | $55,261 (S) $75,996 (M) | $1000 & 25% discount on water bills | Instructions & application |

| Senior Work-off | 5K | Over 60 | Somerville resident | Contact Council on Aging | None | Up to $1,500 | Apply with Council on Aging: (617) 625-6600 ext. 2300 |

| Community Preservation Act (CPA) Exemption | Chapter 44B | Own & occupy Somerville home as your principal domicile on previous January 1 | See income limits | Depends on age and household size. See full listing here. | None | If qualified, exempts all of CPA surcharge. | Instructions & application |

Elderly Exemption

Qualifying seniors, widows, and others may apply for additional exemptions allowed under state law. This includes the 41C Elderly Exemption of $1,000 for qualifying low-income seniors 65 and over (see income and asset limits in overview). If your income is too high for the 41C exemption but you have low assets, you may qualify for a 17D elderly exemption. The 17D Exemption of $344 for qualifying seniors 70 and over (see asset limits in overview). If you qualify for an elderly exemption this will give you in addition to the RE tax exemption a 25 % discount on your water bill.

Hardship

In cases of extreme hardship, seniors may qualify to have all or a portion of their tax bill waived. Hardship is based on three factors that must all be met: age, infirmity, and income. This option is for homeowners who are older, very low-income, and who also suffer from a physical or mental illness, impairment, or disability. The hardship exemption is granted at the sole discretion of the Board of Assessors.

Veterans

Several exemptions are available to veterans of the armed forces who have suffered a service connected disability of not less than 10%, or of a veteran who received a U.S. military decoration award. Disabled veterans can apply for a personal exemption, a VA letter mentioning the percentage of disability is required, and you need to be a Mass resident 6 months prior to service or have 5 years Mass residency. Like the other exemptions the applicant needs to own and live at their property. The amount of the exemption varies per disability. You can find a more detailed explanation in our instruction letter (click here for more information).

Blind

If you are blind you may qualify for an exemption in the amount of $500 under clause 37A. A letter from your doctor indicating blind status or a certificate from the Massachusetts Commission for the blind is required.

Delay Paying Your Taxes (Tax Deferral for Seniors)

The Senior Tax Deferral program allows qualifying seniors age 65 or over to delay paying all or a portion of their tax bill as long as they live in and own their home. That way seniors can free up some of their resources to help cover their living expenses. Tax deferral works like a loan. Currently, 2.5 percent simple interest is charged on the amount deferred. Payment is not due until the house is sold or transferred to heirs or others. You can find a more detailed explanation in our instructions (click here for more information).

CPA Exemption

Full exemptions from the Community Preservation Act (CPA) surcharge are available to any income-eligible seniors age 60, and for who are under certain income limits. For example, individual seniors with an income at or below $112,630., or married seniors at or below $128,720., qualify. Limits increase with family size, and deductions for dependents and medical expenses may also help you come in under these limits. You can find a more detailed explanation in our instruction letter (click here for more information).

Senior Tax Work-Off Program

The Senior Tax Work-off program is just what it sounds like. Any income-eligible senior over 60 may opt to work off up to $1,500 of their annual tax bill by doing light office or other helpful work for the City. By law, the hourly pay rate is the State minimum wage of $14.25 per hour (per 1/1/2022). That means it takes about 106 hours to work off the full $1,500, or about 3 hours per week. Work-off jobs include light office work or youth services, such as reading storybooks to children. We make every effort to find available work with duties that match your skills and abilities. Call Council on Aging at (617) 625-6600 x2300 to learn more.

Upcoming Important Dates |

|

| December 31, 2025 | Third-quarter actual tax bills are mailed with new fiscal year assessment and tax rate |

|

January 1 to February 2, 2026

|

Official appeal period to request changes to FY26 valuations by filing for a Property Tax Abatement |

| February 2, 2026 | Third-quarter actual tax bill due and deadline for filing for a property tax abatement (4:30 p.m.) |

| March 1, 2026 | Form of List Personal Property due |

| March 1, 2026 | 3ABC Form not for profit orgs due |

| April 1, 2026 | Deadline to file for Residential and/or Statutory Exemptions (4:30 p.m.) |

| April 30, 2026 | Income & Expense Forms due (Commercial and Industrial Use / Mixed Use / Apartment Use) |

Frequently Asked Questions

Who determines the tax rate and why can’t it simply be lowered to reduce taxes?

Property taxes are a direct result of two factors: the assessed value for all property (minus exemption values for the fiscal year in question) and the City’s financial obligations (the required property tax levy) as determined in the adopted budget for that fiscal year. Once these two factors are known, the setting of the tax rate is not discretionary. It becomes a straightforward mathematical exercise as follows:

Classified Tax Rates = Property Tax Levy/Property Values Minus Exemption Values

Who determines my value and how is that process completed?

The Board of Assessors calculates values based upon real estate market conditions in accordance with State Department of Revenue (DOR) regulations. The Assessors thus use the three accepted appraisal approaches to value including replacement cost, sales comparisons, and a review of income generated by the property. FY26 assessments will be established based upon market value as of January 1, 2025.

What can I do if I disagree with my assessment?

The FY26 deadline to file an appeal with the Board of Assessors is no later than Monday, February 2, 2026. Applications must be received in the Assessors by the close of business at 4:30 p.m. Mailed applications will also be accepted if they are postmarked by the U. S. Post Office by no later than February 2.

Can the Mayor or my City Councilor get my assessment reduced?

No. The law prohibits this. Elected officials cannot decrease an assessment based upon hardship or for any other reason. By law, assessments must be determined by the Assessors according to State DOR regulations. Assessments cannot be arbitrarily lowered to reduce the tax liability. Only the Assessors have authority to grant abatements under Massachusetts General Law, Chapter 59 and reductions are granted only if additional information indicates that the value should be lowered.

I’m over 65, a widow or have limited income. Are there any other tax savings programs I can apply for?

State law affords a number of property tax discounts or what are known as statutory exemptions as well as options for seniors to work-off a portion of their tax bill or, if eligible, to defer payment. Exemptions can be granted for seniors, widows, veterans and others based upon, in most cases, asset and income guidelines. Please contact the Assessor’s Office to discuss your situation and how to apply. Walk-ins during business hours are always welcome or call (617) 625-6600 x3100. Applications can also be downloaded on this website, please go to the tab 'personal exemptions & other tax relief'.

My assessment and resulting taxes went up more than 2 ½ percent. How can the City exceed Proposition 2 ½?

Proposition 2 1/2 caps the percent increase over the previous year in total property tax dollars collected for all properties in the city combined. In other words, without an override, a city may not collect property taxes in total from all sources that exceed 2 ½ percent more than the previous year. However, the limit does not apply to individual properties. Some properties undergo improvements or require adjustments due to inspection that increase an individual property’s value by more than 2 ½ percent. For example, a $400,000 two-family that undergoes improvements that raise its value to $600,000 increased in value by $200,000 or 50%. That $200,000 increase is what is known as “new growth.” The additional values created by new growth and the resulting tax dollars are exempt from the limits of proposition 2 1/2. In Somerville, new growth can be captured up to June 30th prior to the start of the new fiscal year on July 1. Any improvements are assessed as if in existence on the prior January 1 and are not part of the 2 1/2 percent limit.

Do I have to allow the Assessors to inspect my property?

There are several reasons why the Assessors inspect properties including sales verification for properties that have sold, building permit review, and remeasure-relist for properties that have not been inspected in some time. While no property owner is required to permit an inspection, failure to do so will require that the Board of Assessors estimates your property’s interior condition and features. The estimate could lead to an incorrect or misleading assessment. If the property owner has filed an appeal, failure to grant the inspection will require that the Board disallow the appeal. The Assessors rely on the cooperation of taxpayers to ensure a fair and equitable process leading to the development of fair and equitable assessments. The inspection process is therefore of vital importance to both the Assessors and taxpayers. Inspections can also be beneficial to the property owner by correcting bad data that caused an overvaluation.

What is Classification and how does it affect my taxes?

Classification is a system under State law that allows cities and towns to have one tax rate for commercial property and a different rate for residential property. Whether or not a municipality will classify is a decision recommended by the Mayor and approved by the City Council. Somerville has a long history of approving classification, which allows a greater percentage of the tax liability (an additional 175%) to be shifted to the commercial sector. For example, in FY 2023, commercial value was 16.65% of total value. However, with classification, their contribution was increased to 29.1%. The more commercial value we have, the greater the commercial tax levy contribution and the smaller the residential share.

The Motor Vehicle and Trailer Excise Tax is imposed on anyone who registers a motor vehicle or trailer in Massachusetts. A tax is incurred for each year of registration. In some cases, you may qualify for a tax abatement or refund. Please note that filing an abatement application does not stay the collection of your excise tax. To avoid interest charges and collection actions, you must pay your excise tax in full by the deadline on your bill. If an abatement is granted, you will receive a refund for the difference.

Excise Abatement Instructions | Español | Portugues | Kreyol Ayisyen | 简体中文

PERSONAL PROPERTY: FORM OF LIST

Personal Property is assessed separately from real estate. This tax is assessed upon non-real estate, tangible assets. These assets are composed of good, material objects and other things capable of material ownership that are not part of real estate.

The Board of Assessors, as required by the Commonwealth of Massachusetts, is in the process of reviewing and inspecting all tangible, personal property associated with Somerville businesses for fiscal year starting on July 1. This includes all machinery, equipment, inventory, etc. used in the conduct of your business as of January 1. This review of your business personal property is designed to provide the Assessors with accurate information that will establish fair and equitable values throughout the City.

The Board of Assessors is requesting business owners to complete the form of list and submit it by March 1. If a Form of List is not received, the Board will estimate your value, which may result in an increase. Failure of an owner or lessee to comply with this request, will bar them from any statutory appeal under Massachusetts General Law, Chapter 56 Section 36.

Please note that since the beginning of fiscal year 2021 businesses with personal property under $9,999 are exempt to being taxed.

If you closed your business in Somerville, please complete & sign a personal property affidavit, and mail or email the affidavit to: assessing@somervillema.gov. Note that you will receive your first personal property bill a year after you opened your business in Somerville, and that you will receive personal property bills for a year after you closed your business in Somerville.

COMMERCIAL, INDUSTRIAL, AND APARTMENT PROPERTIES: ANNUAL INCOME AND EXPENSE FILING

The Board of Assessors is requesting income and expense information on commercial, industrial, and apartment properties to help us determine equitable values for assessment purposes. In accordance with State Law, all information listed on the forms is not available to the public for inspection. [CH 59 S52B]. While it is in the best interest of property owners to contribute to the establishment of fair assessments, Massachusetts Law also requires such disclosure: Section 38D of Chapter 59.

Please return the completed Income & Expense forms by April 1.

- Income and Expense Form - Commercial and Industrial Use Property

- Income and Expense Form - Mixed Use Property

- Income and Expense Form - Apartment Use Property

PROPERTIES WITH EXEMPT STATUS: FORM 3ABC

Institutions and organizations, such as hospitals, schools, churches and cultural facilities, may qualify for exemption from local taxes on their real and personal property. These exemptions are found in various clauses of Massachusetts General Laws Chapter 59, Section 5 (M.G.L. c. 59, § 5). However, a religious or charitable organization is not automatically exempt from local taxation when it organizes or acquires property. It must meet specific eligibility criteria and follow certain procedures to obtain an exemption.

A charitable organization owning property on January 1 for which it claims exemption for the fiscal year beginning on the following July 1 must file a charitable property return (Form 3ABC) listing the property. A religious organization must file the return only if it claims a charitable exemption for real property other than a house of worship or parsonage. The return must be received in the assessors’ office by March 1.

For more information, please read the taxpayer’s guide published by the department of revenue.

The Board of Assessors is requesting charitable organizations to complete the form 3ABC and submit it by March 1. If a Form 3ABC is not received, the Board of Assessors will review the exempt status of the charitable organization.

Feedback

Please submit website feedback using this form. Be sure to include:

Thank you for your feedback!